Scout24 updates full-year outlook after strong first quarter

- Group revenue grows by 5.2% year-on-year to EUR 93.8 million

- Investments pay off: 94.8% Realtor Lead Engine revenue growth

- Free-to-list revenue decline is more than offset by Consumer subscriptions

- Management Board expects higher revenue growth for the full year at an ordinary operating EBITDA margin of up to 60%

Munich/Berlin, 12 May 2021 – In the first quarter of 2021, the Scout24 Group increased its revenue by 5.2% to EUR 93.8 million (Q1 2020: EUR million) against a strong prior-year quarter, which was largely unaffected by the pandemic. This was mainly due to the increased investments in growth products within the Residential Real Estate business. These include the Consumer subscription “Plus-products” as well as the “Realtor Lead Engine” mandate acquisition product for agents. The resulting change in revenue mix reflects the consistent development of ImmoScout24 into a comprehensive market network. The Business Real Estate revenues decreased due to the pandemic, and revenues in the Media & Other segment were also weaker year-on-year.

This revenue structure combined with a stable ordinary operating EBITDA resulted in a lower margin of 58.7%. This is partly related to the ongoing Covid-19 situation and partly to growth investments and dis-synergies resulting from the AutoScout24 sale. For the full year, the Management Board is upgrading its revenue outlook due to the strong first quarter with a margin outlook of up to 60%.

“Our increased focus on product innovation is paying off, and the continued development of ImmoScout24 into a comprehensive market network with a transaction-based revenue mix is making good progress. Our recent acquisition of Vermietet.de will also contribute to this development in the future. We will continue our path in 2021 to expand our leading position in the real estate ecosystem and ensure long-term sustainable value creation for our stakeholders,” comments Tobias Hartmann, CEO of Scout24 AG.

“Financially, the Scout24 Group is in excellent shape. In terms of our roadmap to return capital to our shareholders, we have reached an important milestone with the recently completed public share repurchase offer. Based on our financial performance and sustainable high cash generation capabilities, we are well prepared for the upcoming growth steps. This includes the capacity to finance suitable acquisitions. On this basis, we will consistently continue our path towards a comprehensive market network,” explains Dirk Schmelzer, CFO of Scout24 AG.

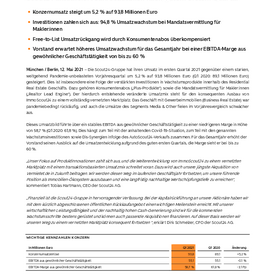

Key financials Group

(EUR million) | Q1 2021 | Q1 2020 | Change |

Group revenue | 93.8 | 89.1 | +5.2% |

Ordinary operating EBITDA | 55.1 | 55.1 | -0.1% |

Ordinary operating EBITDA margin | 58.7% | 61.8% | -3.1pp |

|

Residential Real Estate business on growth track

The Scout24 Group's growth was driven by the Residential Real Estate business with a revenue increase by EUR 5.4 million or 8.5% to EUR 68.8 million in the quarter under review (Q1 2020: EUR 63.4 million).

The revenue with professional customers contained therein, i.e., real estate agents and property managers, increased by 4.9 million euros or 11.3%. The main reason for this development was the strong increase of EUR 3.6 million or 94.8% in the "Realtor Lead Engine" revenue, which includes the newly added revenue of immoverkauf24. The ARPU (average revenue per user per month) of the Residential Real Estate Partners rose slightly by 1.1% compared to the strong prior-year quarter to EUR 737. The focus is currently more on a successful migration to the new membership editions than on pricing.

Revenue from consumers contained in the Residential Real Estate segment increased by 2.5%. This means that the revenue loss due to the introduction of free-to-list at the end of Q1 2020 was over-compensated for the first time by the growth of the Plus-product revenues (+28.0% compared to Q1 2020).

The ordinary operating EBITDA margin of the Residential Real Estate segment was 61.7% in Q1 2021, 3.3 percentage points below the 65.0% in the previous year. On the one hand, this reflects the foregone private listing revenues and, on the other hand the changed revenue mix due to the high-growth Plus-products and the Realtor Lead Engine product (including immoverkauf24).

Business Real Estate still weakened by Covid-19

The Business Real Estate revenue decreased by 3.8% to EUR 17.2 million (Q1 2020: EUR 17.9 million) due to the pandemic-related decline in revenue with business real estate agents. Revenue with project developers and new home builders increased slightly against the strong prior-year quarter. ARPU for the first quarter was EUR 1,758, down 2.9% year-on-year. This decrease is primarily due to the decline in revenue with Business Real Estate agents.

The ordinary operating EBITDA margin of the Business Real Estate segment fell by 1.7 percentage points year-on-year to 71.9% in Q1 2021 (Q1 2020: 73.6%). Main reason for this was the pandemic-related decline in revenue, which could not be recouped on the cost side.

Media & Other segment stable at lower level

The Media & Other segment revenue declined by 1.8% from EUR 7.8 million in Q1 2020 to EUR 7.6 million in Q1 2021. The main reason for this was the market and pandemic-driven decline of the third-party advertising business. ImmoScout24 is now increasingly offering advertising space "internally" to the core customers. FLOWFACT also recorded declining revenues due to the ongoing shift in the payment model. The growing business of ImmoScout24 Austria had an opposite effect.

The ordinary operating EBITDA margin of the Media & Other segment fell by 6.3 percentage points year-on-year from 39.9% to 33.6%.

Non-financial Performance Indicators

| Q1 20211 | Q1 20201 | Change |

ImmoScout24.de listings1 | 391,479 | 408,152 | -4.1% |

ImmoScout24.de monthly users (million)2 | – | 14.7 | – |

ImmoScout24.de monthly sessions (million)3 | 107.7 | 105.8 | +1.8% |

- Source: ImmoScout24.de; listings in Germany (average as of the end of the month)

- Due to a change of provider, no data is available for the quarter under review; the reported figure for the previous year represents the monthly unique visitors to ImmoScout24.de (average of the individual months), irrespective of how often they visit the marketplace in a month and irrespective of how many different access points (desktop and mobile) they use; source: AGOF e. V.

- Number of all monthly visits (average of the individual months) in which individual users interact with the website or app via a device; a visit is considered completed if the user is inactive for 30 minutes or more; source: internal measurement using Google Analytics.

Upgraded revenue forecast with ordinary operating EBITDA margin of up to 60%

The positive revenue development (+5.2%) in the first quarter of 2021 shows how Scout24 is consistently implementing its ecosystem strategy, i.e. the development of ImmoScout24 into a comprehensive market network. With a persisting impact from Covid-19, revenue growth was primarily driven by growth products such as TenantPlus+ and Realtor Lead Engine. At the same time, good progress was made in migrating the Residential Real Estate partners to the new membership editions. This should be largely completed by the beginning of the second half of the year. From then on, assuming a markedly improved pandemic situation and the continuous expiry of Corona-discounts agreed on a case-by-case basis, ARPUs should rise more strongly again. Moreover, the Business Real Estate business should also recover from then on.

The Vermietet.de acquisition perfectly fits into this market network strategy. It gives Scout24 a significant head-start in product development for the rent market, which is key in Germany and Austria. With Vermietet.de, Scout24 is expanding its offer for private landlords – building on the LandlordPlus product – over the lifecycle of one or even several tenancies. The Management Board expects Vermietet.de to deliver strong revenue growth as part of the ImmoScout24 ecosystem over the next years. The investments will initially have a negative impact on the EBITDA margin, while the Management Board expects a positive effect on the Group margin in the mid-term.

Disregarding Vermietet.de, the Management Board raises the revenue outlook for the current financial year from a "mid-single-digit percentage growth rate" to a "mid to high single-digit percentage growth rate".

Translated into our three segments, this means:

- Residential Real Estate: low double-digit percentage growth rate

- Business Real Estate: low single-digit percentage growth

- Media & Other: slightly declining

Ordinary operating EBITDA only remained stable in absolute terms in the first quarter. However, looking at the full year, the Management Board sees an accretive ordinary operating EBITDA for the Group. At the same time, its focus is on fully leveraging the current market opportunities. Therefore, considering a corresponding increase in the cost base, the Management Board expects an ordinary operating EBITDA margin (including holding costs) of up to 60%.

Quarterly statement Q1 2021

The complete Q1 2021 quarterly statement is available at www.scout24.com/en/investors/financial-reports-presentations.

About Scout24

Scout24 is one of the leading digital companies in Germany. With the digital marketplace ImmoScout24, for residential and commercial real estate, we successfully bring together homeowners, real estate agents, tenants, and buyers - and we have been doing so for more than 20 years. With around 13.8 million users per month, ImmoScout24 is the market leader for digital real estate listing and search. To digitise the process of real estate transactions, ImmoScout24 is continually developing new products and building up an ecosystem for renting, buying, and commercial real estate in Germany and Austria. Scout24 is a listed stock corporation (ISIN: DE000A12DM80, Ticker: G24) and member of the MDAX and the DAX50 ESG. Further information is available on Twitter and LinkedIn. Since 2012, ImmoScout24 has also been active in the Austrian real estate market.

Media Relations

Viktoria Götte

Senior Manager Corporate Communications & PR

Tel.: +49 89 26202 4943

E-Mail: [email protected]

Investor Relations

Ursula Querette

Head of Investor Relations

Tel.: + 49 89 262 02 4939

E-Mail: [email protected]

Disclaimer

All information contained in this document has been carefully prepared. However, no reliance may be placed for any purposes whatsoever on the information contained in this document or on its completeness. No representation or warranty, express or implied, is given by or on behalf of the Company or any of its directors, officers or employees or any other person as to the accuracy and/or completeness of the information contained in this document and no liability whatsoever is accepted by the Company or any of its directors, officers or employees nor any other person for any loss howsoever arising, directly or indirectly, from any use of such information or opinions or otherwise arising in connection therewith.

The information contained in this release is subject to amendment, revision and updating. Certain statements, beliefs and opinions in this document are forward-looking, which reflect the Company's or, as appropriate, senior management's current expectations and projections about future events. By their nature, forward-looking statements involve a number of risks, uncertainties, assumptions and other factors that could cause actual results, including but not limited to the Company's financial position or profitability, to differ materially, also adversely, from those expressed or implied by the forward-looking statements. Statements contained in this document regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. The Company does not undertake any obligation to update or revise any information contained in this document (including forward-looking statements), whether as a result of new information, future events or otherwise. You should not place undue reliance on forward-looking statements, which speak only as of the date of this press release.

Scout24 also uses alternative performance measures, not defined by IFRS, to describe the Scout24 Group’s results of operations. These should not be viewed in isolation, but treated as supplementary information. Alternative performance measures used by Scout24 are defined at the corresponding place in the report. The special items used to calculate some alternative performance measures arise from the integration of acquired businesses, restructuring measures, impairment losses, gains or losses on sale resulting from divestitures and the sale of shareholdings, and other expenses and income that generally do not arise in conjunction with Scout24’s ordinary business activities.

Due to rounding, numbers presented throughout this statement may not add up precisely to the totals indicated, and percentages may not precisely reflect the absolute figures for the same reason. Information on the quarterly financials has not been subject to audit and is thus preliminary

![[Translate to English:]](/fileadmin/_processed_/a/3/csm_210512_Scout24_Media_Release_Q1_2021_478bf3c62b.png)